Real-time retail and wholesale pricing intelligence to optimize valuations, pricing strategies, and margin performance

Pricing vehicles accurately is no longer about checking a single guide or relying on last month’s data. Vehicle Pricing Intelligence helps businesses understand how vehicles are actually priced and moving in the market today. By combining live retail and wholesale comparables with broader market signals, this insight supports stronger valuations, more confident pricing strategies, and more consistent margin performance.

Powered by VinAudit automotive market data, available via APIs and data feeds, this use case supports dealership teams, online marketplaces, software providers, and startups that need pricing signals grounded in current market activity.

Why Pricing Intelligence Matters

Vehicle pricing has become increasingly volatile. Inventory levels fluctuate by region, incentives change frequently, and competitors adjust prices in near real time. Seasonal demand patterns and broader economic factors further complicate pricing decisions, making it harder to rely on static benchmarks.

When pricing strategies depend on delayed or static data, teams risk mispricing inventory—either holding vehicles too long or leaving margin on the table. Inaccurate appraisals and slow reactions to market changes directly affect profitability and inventory health.

Pricing intelligence helps organizations keep decisions aligned with what the market is doing today—not what it did weeks ago.

- Stay aligned with current, hyperlocal market behavior rather than historical assumptions.

- Ground appraisals and retail decisions in real competitive context.

- Detect pricing risks earlier, before units age or margins shrink.

- Adjust more confidently as market conditions evolve.

How Market Data Improves Pricing Accuracy

A closer look at the capabilities that make precise, up-to-date pricing decisions possible. For technical details, see the Market Listings API documentation.

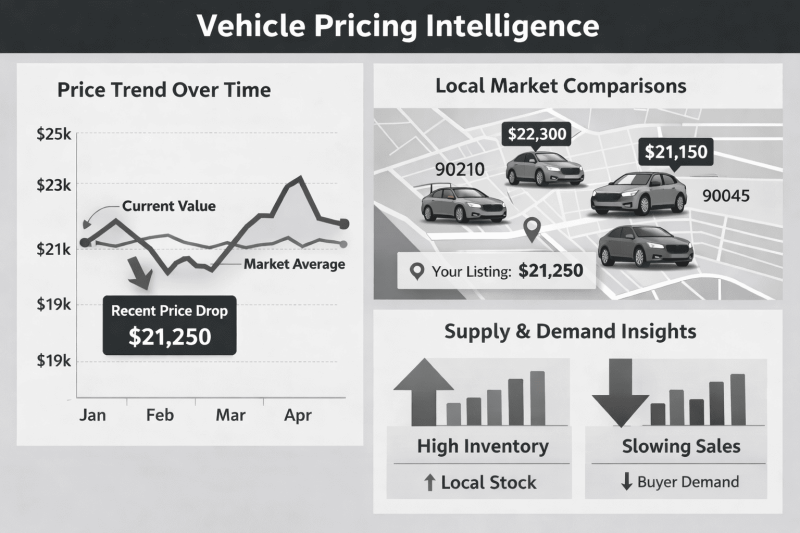

- Live visibility into retail and wholesale comparables across ZIP codes (U.S.) and postal codes (Canada).

- Tracking competitor price adjustments to catch discount activity and rapid shifts.

- Supply- and demand-driven signals to understand when prices face pressure or when demand supports stronger valuations.

- Continuously refreshed pricing indicators delivered via APIs and data feeds so models reflect current market activity rather than outdated snapshots.

Dealerships, marketplaces, and platforms use pricing intelligence to act sooner and price more confidently. Small adjustments made with better data often translate into faster turns and stronger margin performance. Pricing intelligence supports teams responsible for setting prices and evaluating acquisitions, and it is powered by targeted data signals that track how market values evolve. The tables below outline who benefits and the data inputs driving the insight.

Together, these user groups and data signals form the foundation of effective pricing strategy. By combining market insight with the teams responsible for daily pricing and acquisition decisions, businesses gain clearer visibility into where the market is heading — and the confidence to act with precision. The following example illustrates how pricing intelligence is applied in a real-world decision, showing how current market data helps teams respond to pricing pressure and improve outcomes. A dealership preparing to price a 2020 Honda CR-V reviews live comps across surrounding ZIP codes and notices a downward shift caused by rising local inventory. Instead of relying on stale guide values, the manager adjusts pricing early, increasing shopper engagement. The vehicle sells ahead of similar units in the market, improving both turn rate and retained margin.

Request a demo to see how these pricing signals work in real dealer workflows.

How Businesses Apply Pricing Intelligence

Who Uses Pricing Intelligence — and What Data Powers It

Ideal Users (Who Applies This Insight)

Dealership Pricing Teams

Use updated benchmarks to maintain competitive pricing.

Used-Car Managers

React quickly to shifts in demand and competitor activity.

Appraisal & Acquisition Teams

Ground trade-ins and purchase decisions in current market data.

Online Marketplaces & Software Providers

Surface pricing guidance within internal tools and customer-facing workflows.

Data Signals Behind This Use Case (What Powers It)

Retail & Wholesale Comparables

Pricing matched by VIN detail, trim, mileage, and ZIP / postal code.

Competitive Listings

Active price points, adjustments, and discount trends.

DOM & MDS Metrics

Indicators of sales velocity and market saturation.

Historical Price Movement

Trend lines and seasonal shifts over time.

Supply & Demand Curves

Pressure signals showing how inventory enters or leaves the market.

Example of Pricing Intelligence in Practice

Explore VinAudit’s Automotive Market Data Platform

Vehicle Pricing Intelligence is one part of a broader market intelligence platform that supports pricing, inventory, competition, and risk decisions across the automotive ecosystem. Visit the full Automotive Market Data page to see how these insights connect.